SHRIKANT D. KULKARNI, J.

1. Heard finally at admission stage with consent of both the sides.

2. Unsuccessful original defendant Nos. 2 to 4 have preferred this second appeal against

impugned Judgment and decree passed by the District Court in Regular Civil Appeal No.

149/2014 arising out of Judgment and decree passed in Regular Civil Suit No. 192/2009 by the

learned 4th Jt. Civil Judge Junior Division, Parbhani.

3. The appellants have purchased the suit property from respondent No. 2/adopted son of

Kausalyabai (original plaintiff No.1 since deceased) vide three registered sale deeds dated

02.06.1995. The adoptive mother ( Kausalyabai) and sister Parwatibai had filed a suit on

17.08.2019 for declaration of ownership, recovery of possession with further declaration that sale

deeds executed by defendant No.1 (adopted son) in favour of the appellants are not binding their

shares.

4. During pendency of the suit, original plaintiff No. 1/ Kausalyabai died and suit was contested

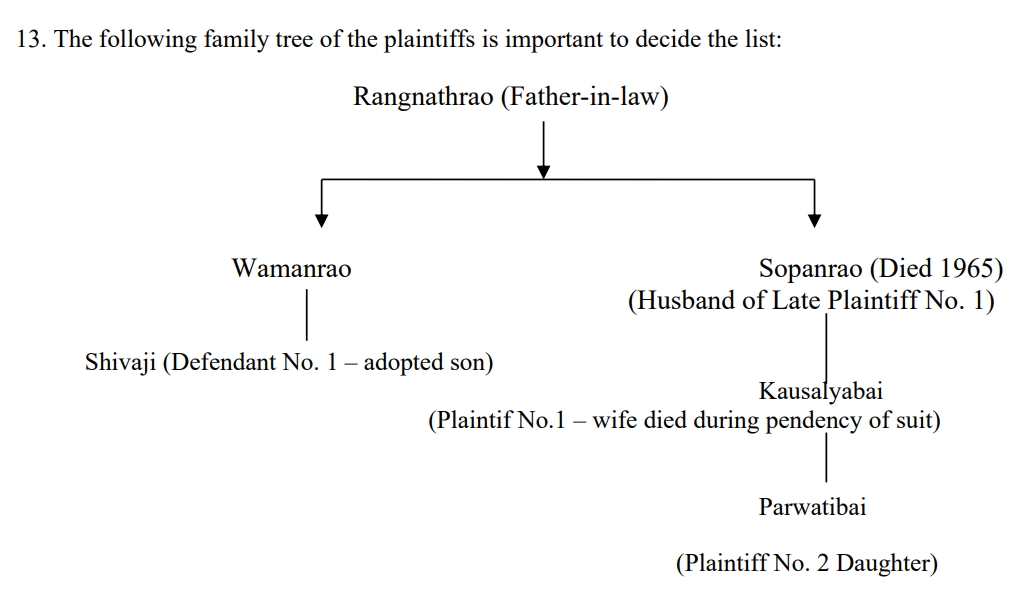

by plaintiff No.2/Parwatibai. The trial court was pleased to decree the suit partly as under :

01. Suit of the plaintiff is partly decreed as follows.

02. Plaintiff No. 2 is declared as owner of suit property to the extent of her half share.

Defendant No.1 is declared as owner of suit property to the extent of his remaining half

share.

03. Sale Deed bearing No. 1418/1995, 1419/1995, 1420/1995 all dated 02.06.1995

executed by defendant No.1 in favour of defendants No. 2 to 4 in respect of suit property

Gut No. 95 ad measuring total area 8 Hector 95 Are situated at village Pimpalgaon Tong,

Tq. & Dist. Parbhani (more particular described in claim clause of plaint) is declared as

null and void to the extent of half share of plaintiff No. 2 and not binding on the plaintiff

No. 2 Parwatabai.

04. Plaintiff No. 2 is entitled to recover her half share in the suit property.

5. Feeling aggrieved by the impugned Judgment and decree passed by the learned 4th Jt. Civil

Judge Junior Division, Parbhani, original plaintiff No. 2/Parvatibai Bhimrao Bende has filed

Regular Civil Appeal No. 149/2014. The said appeal came to be allowed as under :

224

01. The appeal is allowed with costs

02. The cross-objection filed by defendants/respondents is dismissed

03. The judgment and decree passed by 4th Jt. Civil Judge Junior Division, Parbhani in

R.C.S. No. 192/2009, dt. 30/09/2014 is hereby set aside.

04. The suit is decreed. The appellant is declared as owner of suit property and entitled

for recovery of suit property from defendant Nos. 2 to 4. Defendant Nos. 2 to 4 shall evict

within one year

05. Sale deeds bearing registration No. 1418/1995 to 1420/1995 dt.02/06/1995 Exh. 30 to

Exh. 32 are illegal and not binding on the plaintiff.

06. R & P be send to trial Court.

07. Decree be drawn up accordingly

7. Feeling aggrieved by the impugned Judgment and decree passed in Regular Civil Appeal No.

149/2014, the appellants/original defendant Nos. 2 to 4 have preferred the second appeal by

raising precise substantial questions of law.

8. Heard MrPrakashsing B. Patil, learned counsel for the appellants and MrShahaji B. Ghatol

Patil, learned counsel for respondent No.1/original plaintiff No.2.

9. It is revealed during the course of argument and while perusing the impugned Judgment and

decree passed by the appellate court as well as the trial court that both the Courts below have

committed an error in the eye of law while determining the shares. So far as the question of

adoption of defendant No. 1/Shivaji S/o Wamanrao alleged adopted son of Sopanrao Tong is

concerned, both the Courts below have accepted and held that defendant No.1 is adoptive son of

late plaintiff No. 1/Kausalyabai. It is therefore, clear that both the Courts below have recorded the

concurrent findings in respect of adoption of defendant No.1. There is no need to go through that

aspect in view of concurrent findings recorded by the Courts below.

10. Following are the substantial questions of law framed in this second appeal after hearing

learned counsel for both the sides. (i) Whether the principle of relation back is applicable to the

present case in view of section 12 of the Hindu Adoptions and Maintenance Act, 1956 ? (ii) What

would be the share of original plaintiff No.2- Parwatibai/daughter in the suit property ? (iii)

Whether the sale deeds executed by original defendant No.1/ ShivajiraoWamanrao adopted son of

plaintiff No.1 are binding upon the original plaintiff No. 2 ? If yes, to what extent and share ? (iv)

Whether the Courts below if any committed an error in determining the share of the parties in

view section 8 and 15 of the Hindu Succession Act, 1956 ? (v) Whether the intervention is

necessary ?

225

11. The claim in the original suit put forth by the plaintiffs was for declaration of ownership and

recovery of possession of land bearing Gut No. 95 admeasuring 8 Hectares 59 R situated at

village Pimpalgaon Tong.

12. Following 2.80R land has been purchased by the appellants/defendant Nos. 2 to 4 by three

different sale deeds from original defendant No.1/Shivaji.

14. MrPrakashsing B. Patil, learned counsel for the appellants vehemently argued that though

defendant No.1/ Shivaji was adopted in the year 1973, for all the purposes, he shall be deemed to

be a child of his adoptive parents. He submitted that all the ties of the child in the natural family

will stand terminated from the date of adoption, except the ties of blood for the purpose of

marriage. He further submitted that all the ties of child would come into existence in the adoptive

family from the date of adoption. The adopted child is deemed to be the child of adopter for all

the purposes and his position for all intents and purposes is that of a natural born son. He has the

same right, privilege and same obligation in the adoptive family.

15. MrPrakashsing Patil, learned counsel for the appellants has placed his reliance in case of

Hiralal Vs. Board of Revenue reported in AIR(RAJ)-2001-2001-0-318. By placing reliance on

the said decision, MrPrakashsing Patil, learned counsel for the appellants submitted that the

moment, the widow of a co-parcener adopts a son, the adopted son becomes a co-parcener with

surviving co-parceners of the adoptive father and consequently, the same interest which his

adoptive father would have in the property had he been living. The child adopted by the widow of

the co-parcener became the child of deceased co-parcener from the date of death of the coparcener. He therefore, vehemently submitted that adopted son gets equal share like her adopted

mother.

227

16. Per contra, MrShahaji B. Ghatol Patil, learned counsel for respondent No.1/original plaintiff

submitted that even if for the sake of argument accepted that Shivaji/original defendant is adopted

son of Kausalyabai/original plaintiff No.1. He may not get equal share. He submitted that

husband of plaintiff No.1 (Kausalyabai) namely, Sopanrao died in the year 1965 left behind

plaintiff No.1 as widow and plaintiff No. 2 as daughter. Both of them got one half share each in

the suit property left behind by Sopanrao. He submitted that Shivaji was allegedly adopted by

Kausalyabai in the year 1973. He submitted that the succession opens in the year 1965 soon after

death of Sopanrao who happened to be the father of plaintiff No.2 and husband of plaintiff No.1.

The adopted son does not get any share even after his so-called adoption in the year 1973. At the

most, he may get share after death of Kausalyabai/original plaintiff No.1 in her one half share. In

that case, Parwatibai being daughter and Shivaji being adopted son would get equal share in the

share of Kausalyabai. He submitted that theory of relation back is not applicable to this case since

so-called adoption has taken place in the year 1973.

17. MrShahaji B. Ghatol Patil, learned counsel for the original plaintiff submitted that, the sale

deeds executed by Shivaji (adopted son) are not binding on the plaintiff and submitted that those

sale deeds need to be declared not binding on plaintiff.

18. I have considered the submissions of learned counsel for both the sides. I have also carefully

gone through the Judgment and decree passed by the trial court in Regular Civil Suit

No.192/2009 and the Judgment and decree passed by the First Appellate Court/District Court in

Regular Civil Appeal No. 149/2014

19. It is undisputed position that the husband of original plaintiff No.1/Sopanrao died in the year

1965 leaving behind Kausalyabai as a widow/plaintiff No.1 and Parwatibai being a daughter

(plaintiff No.2). As per the findings recorded by both the Courts below, Shivaji was adopted by

original plaintiff No.1 in the year 1973 after the Hindu Adoptions and Maintenance Act, 1956

came into force. In that background, I have to see the provisions of the said Act.

20. Section 8 of the said Act provides that a female Hindu, who is of sound mind and is not a

minor, has the capacity to take a son or daughter in adoption. If she has a husband living, the

consent of her husband is necessary for such adoption.

21. Having regard to section 8 of the said Act, plaintiff No.1/Kausalyabai had legal right to adopt

a son or daughter and accordingly, she has adopted son Shivaji in the year 1973 by way of

adoption deed. Her husband was not alive at the time of adoption. Hence, question of consent

does not arise

22. The question comes about effect of adoption. Section 12 of the Hindu Adoptions and

Maintenance Act (HAMA), 1956 provides for the effect of adoption (refer section 12 of HAMA).

228

23. It specifies that an adopted child will sever all ties with the family of his or her birth on and

from the date of adoption. The second proviso of Section 12 of the Hindu Adoptions and

Maintenance Act, 1956 stipulates that any property which has vested in the adopted child before

the adoption shall continue to vest with him subject to the obligations, if any. The second proviso

allows the property vested in the adopted child before the adoption to continue to vest in the

adopted child subject to the obligations, if any, attaching to the ownership of the property

including the obligation to maintain relatives in the family on his or her birth.

24. The question is whether principle of relation back is applicable to the present case in view of

section 12 of the Hindu Adoptions and Maintenance Act, 1956.

25. MrPrakashsing Patil, learned counsel for the appellants has placed reliance on the citation in

case of Hiralal Vs. Board of Revenue (supra). There is decision of this Court on the subject and

the said issue is covered by the decision in case of Banabai and others Vs. Wasudeo, reported in

AIR 1979 Bom. 881 (At Nagpur). When there is direct Judgment of this Court, it needs to be

followed in the said decision. In para No. 18, it is held as under :-

18. Thus it would be seen that the adoption takes effect only from the date of adoption

and not prior to the adoption. Under the former law the adoption had the effect of relating

the adoption back to the date of death of the father. The adopted son was deemed to be in

existence at the time when the father died. That fiction of relation back as a result of the

adoption has been done away with by S. 12. Further the provisions also limit the rights of

the provisions also limit the rights of the adopted son in the new family and proviso (c)

which is material and which deals with the rights in the property as well the right of

management to which MrKherdekar wants me to extend the principle as enunciated by

the Supreme Court is that “the adopted child shall not divest any person of any estate

which vested in him or her before the adoption.” In other words, though the adopted son

from the date of adoption becomes a member of the adoptive family and acquires all the

rights and status which that person would acquire in the adopting family with regard to

the property, his right was controlled and is subject to his incapacity to divest any person

of an estate which has already vested in him. Though, therefore, an adopted son may have

rights in future in the property which the family may acquire after his adoption, with

regard to the property which has vested in any particular person before his adoption, the

adoption does not vest in him any rights with regard to that property. The plain terms of

S. 12 and in particular proviso (c) clearly make it quite clear that the adopted son, short of

acquiring the right of management and right to the property of his adoptive parents

acquires all the other rights and status of a natural born son in the family.

26. In case of Banabai (supra), the principle of relation back as a result of the adoption has been

done away with by section 12 of the Hindu Adoptions and Maintenance Act, 1956. Under the old

229

Hindu law the adoption had the effect of relating the adoption back to the date of death of the

father. The adopted son was deemed to be in existence at the time when the father died. That

fiction of relation back as a result of adoption is no more available in view of Section 12 of said

Act. Having regard to this legal position, I am unable to accept the argument advanced by

MrPakashsing Patil, learned counsel for the appellants. After coming into force of Hindu

Adoptions and Maintenance Act, 1956, the child adopted by the widow of the co-parcener, does

not get the status of the child of deceased co-parcener from the date of death of co-parcener. As

such, adopted son/original defendant No.1 cannot claim share in the suit property, by stepping

into the shoes of his late father who died long before in the year 1965. Therefore, I have recorded

my finding against question No.1 in the negative.

27. It is an admitted position that the husband of original plaintiff No.1/Kausalyabai died in the

year 1965 which is much before the adoption of son Shivaji. Original plaintiff No.1/Kausalyabai

has adopted Shivaji vide adoption deed dated 24.03.1973 as per the findings recorded by both the

Courts below. Therefore, it is clear that adopted son Shivaji was not in picture when the husband

of original plaintiff No.1 Kausalyabai died in the year 1965. The Husband of plaintiff No.1

Sopanrao died intestate in the year 1965. The succession opens for the first time in the year 1965.

According to Section 8 of the Hindu Succession Act, 1956, plaintiff No.1 being widow and

plaintiff No.2 being daughter would get one half share each in the suit property left behind by

Sopanrao.

28. As discussed herein before, husband of plaintiff No.1 and father of plaintiff No.2, namely,

Sopanrao died in the year 1965. The succession opens soon after death of Sopanrao in the year

1965. Plaintiff No.1/ Kausalyabai (widow) and plaintiff No. 2 Parwatibai (daughter) got one half

share in the property left behind by Sopanrao. Shivaji has been taken in adoption though disputed

on 24.03.1973. Plaintiff No.1/ Kausalyabai died during pendency of the suit in the year 2013.

After death of original plaintiff No.1/Kausalyabai, her ½ share would devolve upon her daughter

Parwatibai and adopted son Shivaji. In view of section 15 of the Hindu Succession Act, 1956.

Having considered this legal position, plaintiff No. 2/daughter Parwatibai would get her share of

½ from the share of her mother which comes to ¼ and total share ¾ (½ + ¼ ) whereas adopted

son Shivaji would get ¼ share in the property.

29. It is evident from the record that adopted son Shivaji has sold in all 2 hectare and 80 R land

out of Gut No. 95 by 3 different sale deeds as shown in the chart para No. 13.

30. The original plaintiff No.1/Kausalyabai died in the year 2013. After demise of original

plaintiff No.1/Kausalyabai, her share would devolve between her daughter Parwatibai/original

plaintiff No. 2 and adopted son Shivaji/original defendant No.1. The adopted son Shivaji has sold

the above said suit property in the year 1995 when he has no title and legal interest in the suit

property. Plaintiff No.1 was alive in the year 1995 when adopted son has sold in all 2 hectare and

230

80 R piece of land out of Gut No. 95. At the most, the adopted son Shivaji can be said to have

acquired the legal right after demise of her adopted mother/Kausalyabai in the year 2013.

31. Having regard to the above legal position and in view of section 8 and section 14 and 15 of

the Hindu Succession Act, 1956, the sale deeds executed by original defendant No.1 Shivaji

(adopted son) are certainly not binding upon original plaintiff No. 2. In view of passage of time

and after death of Kausalyabai, adopted son Shivaji has acquired the legal right in the year 2013,

during the pendency of the suit.

32. In view of the above discussion, original plaintiff No.2/Parwatibai would get ¾ share in the

suit property and adopted son Shivaji would get ¼ share in the suit property. The sale deeds

executed by Shivaji (adopted son) in favour of the appellants are certainly not binding on original

plaintiff No. 2 to the extent of her ¾ share. The sale deeds would be binding upon adopted son

Shivaji to the extent of his ¼ share.

33. Having regard to the above reasons and discussion, it is very much clear that both the Courts

below have committed an error in determining the shares of the parties in view of section 15 of

the Hindu Succession Act. As such, intervention in the decree passed by the First Appellate Court

and trial court is required so as to correct the shares of the parties. Therefore, I have recorded my

findings against substantial questions of law accordingly.

34. In the result, following order is passed.

ORDER (A) The second appeal stands disposed of by modifying the decree passed by

both the Courts below as under :-

(i) The suit is partly decreed.

(ii) Plaintiff No.2/Parwatibai is hereby declared as an owner of the suit property to the

extent of her ¾ share whereas defendant No.1/Shivaji is declared as an owner of the suit

property to the extent of his ¼ share.

(iii) The sale deeds bearing No. 1418/1995, 1419/1995 1420/1995 all dated 02.06.1995 in

respect of the suit ` property Gut No.95 executed by original defendant No.1 Shivaji are

hereby declared null and void to the extent of ¾ share of plaintiff No.2/Parwatibai and

not binding on her.

(iv) The sale deeds referred above executed by the defendant No.1/Shivaji in favour of

appellants/ original defendant No. 2 to 4 in respect of suit property shall be binding to the

extent of his ¼ share.

(v) Plaintiff No.2/Parwatibai shall be entitled to recover possession of her ¾ share out of

suit property.

(vi) The decree be prepared accordingly in above terms.

(vii) No order as to costs.

231

(viii) The second appeal is disposed of accordingly.

(ix) In view of disposal of second appeal, civil application also stands disposed of.