| Introduction | jurisprudence |

| sections | section 8-13 Hindu Succession Act |

| Relevant Case laws | Vellikannu vs Singaperumal Nirmala vs NCT of Delhi Babu Ram vs Mallikarjun Vineeta Sharma vs Rakesh Sharma Uttam vs Saubhag Singh Gurupad vs Hirabai Khandappa |

| Present problem | questions related |

| conclusion | Decision as per our reasoning |

A Joint Hindu Family is consist of multiple members in which there is a common male ascendant, male descendants, unmarried female descendants, wife of male descendants and their children. There is no limit on the generation of joint family. Joint family have a common property over which members of Joint family have rights. But, in a case where common property is not there, still they considered to be a joint family as they are sharing common kitchen, common place of worship, common feelings towards each other.

Property can be divided either by testamentary or by intestate. Testamentary is all about will, but intestate is through succession among heirs.Where a person dies, leaving behind some property, but no Will or testament capable of taking effect in law, his property will be distributed among his legal heirs in accordance with the laws of inheritance or of intestate succession. All family laws dealing with succession lay down a scheme of inheritance that is applicable in case a person dies leaving behind property but no instructions with respect to its distribution after his death. The person who dies without making a Will is called an ‘intestate’

There are some rules regarding succession of male intestate. If it is separate property, then property will devolve as per section 8-13 of Hindu Succession Act. But if it is ancestral, then first we have to calculate notional partition, then as per section 8-13.

Sections:

Section 8: General rules of succession in the case of males. – The property of a male Hindu dying intestate shall devolve according to the rules set out in this chapter:(a) firstly, upon the preferential heirs, being the relatives specified in Class I of the Schedule;(b) secondly, if there is no preferential heir of Class I, then upon the preferential heirs being the relatives specified in class II of the Schedule;(c) thirdly, if there is no preferential heir of any of the two classes, then upon his relatives being the agnates specified in Section 12; and(d) lastly, if there is no agnate, then upon his relatives being the cognates specified in Section 13.

class 1 heir:

Mother [M]

Widow [W]

Daughter [D]

Widow of a predeceased son [SW]

Daughter of a predeceased son [SD]

Daughter of a predeceased daughter [DD]

Daughter of a predeceased son of a predeceased son [SSD]

Widow of a predeceased son of a predeceased son [SSW]

Son [S]

Son of a predeceased son [SS]

Son of a predeceased son of a predeceased son [SSS]

Son of a predeceased daughter [DS]

Daughter of a predeceased daughter of a predeceased daughter [DDD]

Son of a predeceased daughter of a predeceased daughter [DDS]

Daughter of a predeceased daughter of a predeceased son [SDD]

Daughter of a predeceased son of a predeceased daughter [DSD]

class 2 heir:

Father

Son’s daughter’s son

brother,

sister

Daughter son’s son

Brother’s son

Sister’s son

Brother’s daughter

Sister’s daughter

Father’s father

Father’s mother

Father’s widow

Brother’s widow

Father’s brother

Father’s sister

Mother’s father

Mother’s mother

Mother’s brother

Mother’s sister

Agnates: Section 3(a) HSA- A person is said to be the agnate of another if the two of them are related by blood or adoption entirely or wholly through males.

Cognates: Section 3(c) HSA- A person is said to be the cognate of another if the two of them are related by blood or adoption, but not entirely through males.

Section 9. Orders of succession among heirs in the Schedule. – Among the heirs specified in the Schedule, those in Class I shall take simultaneously and to the exclusion of all other heirs; those in the first entry in Class II shall be preferred to those in the second entry; those in the second entry shall be preferred to those in the third entry; and so on in succession.

Section 10. Distribution of property among heirs in Class I of the Schedule.- The property of an intestate shall be divided among the heirs in Class I of the Schedule in accordance with the following rules: Rule 1– The intestate’s widow, or if there are more widows than one, all the widows together, shall take one share. Rule 2– The surviving sons and daughters and the mother of the intestate shall each take one share. Rule 3– The heirs in the branch of each pre-deceased son or each pre-deceased daughter of the intestate shall take between them one share. Rule 4– The distribution of the share referred to in Rule 3- i. among the heirs in the branch of the pre-deceased son shall be so made that his widow (or widows together) and the surviving sons and daughters get equal portions; and the branch of his predeceased sons gets the same portion; ii. among the heirs in the branch of pre-deceased daughter shall be so made that the surviving sons and daughters get equal portions.

Relevant Case laws:

Vellikannu vs R. Singaperumal

facts:

The son murdered his father and was convicted by the court. As he was disqualified from inheriting the property of the deceased, his wife claimed the same on the ground that since the murderer would be deemed to be dead, she would be regarded as the widow of the predeceased son and eligible to inherit the property as the intestate’s class-I heir.

The point of contention in the case arose when the appellant filed a complaint at the District-Munsif Court, claiming that it entitled her to Ramasami Konar’s property before her second marriage.She further claimed that it had disqualified the respondent as a legal successor under Section 25 and 27 of the Hindu Succession Act and that only she had the right to claim the estates.The appellant-wife maintained that the respondent-husband must be regarded as having died before the inheritance issue arose and that she, as the only legal successor living, would be entitled to the deceased’s whole assets. The appellant had requested a declaration of relief based on the same.

Issues:

Whether the heir of murderer entitled to get property?

judgement:

It was held that neither the son nor his wife was eligible to claim inheritance. The son cannot inherit any property of his father on the principles of justice, equity and good conscience as he has murdered him and the fresh stock of his line of descent ceased to exist in that case. Once the son is totally disinherited then his whole stock stands disinherited i.e., the wife and the son. The son himself is totally disqualified by virtue of sections section 25 and 27 of the Hindu Succession Act and as such the wife can have no better claim in the property of the deceased.

Consequently, it reasoned that if the son cannot inherit, then the wife, who inherits through her husband, cannot claim the deceased father-in-law’s property either.

Nirmala vs Govt NCT of Delhi

facts:

The widow and the two minor girls of Late Shri Inder Singh were the petitioner in the present case which was for the dispute of a landholder. Preceding his marriage with Nirmala, Late Shri Inder Singh was involved with one more woman Nihali Devi with whom he had two boys and a little girl.Inder wedded Nihali Devi in 1997, after the death of his first spouse in 1995. All 3 Respondent present are the offspring of Late Shri Inder Singh and his first spouse.After the death of Inder Singh in 2006, Nirmala moved an application before the concerned Tahsildar in 2007, to change the mentioned disputed agrarian land for the petitioners, the Tahsildar however considering Section 50 of the Delhi Land Reforms Act didn’t allow it. Nirmala on such reaction called in for a Panchayat conference of the town dated 12.02.2007, settled by the Panchayat it was ruled that against the offspring of Nihali Devi that the share in the disputed farming land possessions claimed by Inder Singh should be divided 1/3rd among the children of Nirmala.This decision gave Nirmala the ownership of a certain portion. On the other hand, children of Nihari Devi made the lives of Petitioner miserable by making deterrents and not permitting the petitioners to work in their fields properly.Nirmala then knocked the doors of the concerned S.D.M and Deputy Commissioner in March 2007, but her application was not entertained. Then a writ petition was documented in August 2007.

Issues:

Even if Section 50 of the Delhi Land Reforms Act has been repealed by the Amendment Act because of letting go of Section 4(2) of the Hindu Succession Act, 1956. In this particular case, do the petitioners presently have the option to succeed in the disputed rural land being female?

judgement:

The assurance or safeguard from obliteration which sub-section (2) gave having been taken out, the arrangements of the HINDU SUCCESSION ACT would have a superseding impact even regarding the arrangements of the DELHI LAND REFORMS ACT. It was, in fact, less an instance of suggested repeal however one where the security from repeal/revocation which until recently existed has now been eliminated.The exclusion of sub-section (2) of Section 4 was a lot of a conscious act of Parliament. The intention was clear. Parliament didn’t need this assurance given to the DELHI LAND REFORMS ACT and other comparative laws to continue. The outcome was that the DELHI LAND REFORMS ACT gets consigned to a place of subservience to the HINDU SUCCESSION ACT to inconsistency in the arrangements of the two acts.The court said that they have seen that the resistance allowed under Article 31B was subject to the force of any competent law-making body to repeal or correct the secured Act (for this situation, the DELHI LAND REFORMS ACT). Parliament has enacted the HINDU SUCCESSION ACT and the Amendment Act of 2005 and there was no test to Parliament’s competency.They effectively showed the issues concerning how the impact of exclusion of sub-section (2) of Section 4 of the HINDU SUCCESSION ACT was to annul the arrangements of the DELHI LAND REFORMS ACT to inconsistency with the arrangements of the HINDU SUCCESSION ACT.Unmistakably, the invulnerability under Article 31B was not a sweeping resistance and was subject to the force of any competent governing body to repeal or correct the secured Act. This was exactly what Parliament has done. In this manner, the contention was raised in the interest of Respondent Nos. 3 to 5 was plainly indefensible.

The Court held that, after the amendment of 2005 the arrangements of the Hindu Succession Act would have more impact over the Sections of Delhi Land Reforms Act (in this particular case Section 50). Which means the rule of Hindi Succession Act would rule over any given rule passed under the Delhi Land Reforms Act. Hence, the petitioners were truly qualified to succeed as the Hindu Succession Act, 1956 in the disputed agrarian land as far.

Babu Ram vs Santokh Singh

facts:

Two siblings, in particular, Santokh Singh, a unique plaintiff, and Nathu Ram, unique Defendant 1, children of Lajpat son of Rupa acquired, among others, certain agricultural terrains after the demise of their dad.As indicated by Santokh Singh, a game plan was shown up, as far as which the siblings were to be in discrete pleasure in specifically determined parcels.Since Nathu Ram was not keen on proceeding with the said game plan, he gave a legitimate notification to Santokh Singh and later executed a registered sale deed on 19-8-1991 regarding his advantage in the grounds for one Babu Ram, unique Defendant 2 son of Kanshi Ram.

issue:

Whether the sale by Defendant No. 1 to Defendant No. 2 is null and void?Whether the sale was for legal necessity and valuable consideration?Whether Section 22 of the Hindu Succession Act applies to the transfer of agricultural land?

judgment:

The Supreme Court observed that “when the Parliament thought of conferring the rights of succession in respect of various properties including agricultural holdings, it put a qualification on the right to transfer to an outsider and gave preferential rights to the other heirs with a designed object. Under the Shastrik Law, the interest of a coparcener would devolve by principles of survivorship to which an exception was made by virtue of Section 6 of the Act.Since the right itself in certain cases was created for the first time by the provisions of the Act, it was thought fit to put a qualification so that the properties belonging to the family would be held within the family, to the extent possible and no outsider would easily be planted in the family properties.” In the considered view of the Court, “it is with this objective that a preferential right was conferred upon the remaining heirs, in case any of the heirs was desirous of transferring his interest in the property that he received by way of succession under the Act.”

The Court held that Section 22 of the Hindu Succession Act applies to agricultural land.Plaintiff has a preferential right to acquire the land under the law.The judgment and decree of the Lower Appellate Court were upheld, and the instant appeal andcross-objection were dismissed Each party was ordered to bear its own costs.

Vineeta Sharma vs Rakesh Sharma

facts:

A Hindu man ‘A’ had constructed a house with his self-acquired property in Delhi and had later thrown it into the joint family hotchpotch. He had one daughter and three sons. Upon his demise as also of one of his sons (the brother), the daughter filed a suit for partition and a claim of 1/4th share of the house as the class-1 heir. The suit for partition was filed in 2002 and the decree was passed by the trial court in 2007. The High Court had held on 29 October 2013 that keeping in view the intention of the parliament to enact the 2005 Act: she would be entitled to a share as per the latest law despite the fact that she had filed the case earlier to 2005.

issue:

Whether a daughter born before 9 November 2005 can claim equal rights and liabilities in coparcenary as that of a son? Whether the statutory fiction of partition created by proviso to section 6 of the hindu succession act, 1956 as originally enacted bring about the actual partition or disruption of coparcenary?

judgement:

*The court, overruling the phulvati and dannmma judgement, ruled that the effects of the provisions of section 6 are neither prospective in nature nor retrospective; but it is retroactive in nature. The concept is explained by the Apex court and means that the equal right of coparcenary will be given to daughter on and from 9 November 2005 but it is based upon some past event i.e. the birth of the daughter. The effects are retroactive as if the daughter never took birth, which is in past, the rights would never have existed in the first place. This approach of the court cleared the lacuna in law as to what effect, in relevance to time, these provisions have. *The court also held that notional partition doesn’t mean that actual partition has been effectuated. As notional partition is a legal fiction, it should be used and implied up to a certain limit and to only fulfil the purpose it was created for. In this case, a notional partition is created as to ascertain the share of each coparcener of the joint Hindu family. The court reiterated that the ascertainment of the shares distributed and fixated upon notional partition are not final, as the birth of a new coparcener or the death of any existing coparcener can either increase of decrease the shares of the other coparceners. It also ruled that, consequentially, a daughter can claim a share in the joint family property even if notional partition is done before 9 November 2005 as the notional partition is not an actual partition and just because of it, the coparcenary property doesn’t cease to exist.

Supreme Court has also interpreted the legislation according to its objects which was to make good a fault in law as the unamended section 6 of Hindu succession act was discriminatory in nature. Accordingly, it has laid down precedence that will ensure that no bogus or sham partitions can lead to deprivation of an equal right of a daughter in Hindu joint family. This judgement successfully cleared all the confusion created by two contradicting judgements before it.

Gurupad Khandappa Mogdum vs Hirabai Khandappa Magdum

facts:

The joint family consisted of the father, his wife, two sons and three daughters. The father died in 1960 as an undivided member of Mitakshara coparcenary and three years later his wife (Hirabai) filed a suit for a partition and separate possession of her seven-twenty fourth share in the property. She claimed a one-fourth share at the time of partition and a one-twenty fourth share by inheritance. On the other hand, the sons contended that the mother was not entitled to get a share at the time of effecting the notional partition and therefore all that she should get is a one-twenty fourth share.

The plaintiff’s contention was that if a partition had taken place between Khandappa and his two sons during Khandappa’s lifetime, the plaintiff would have received a 1/4th share each upon Khandappa’s death. She also claimed that Khandappa’s 1/4th share could devolve upon his death to six sharers, entitling her to a 1/24th share.

issue:

In terms of Sections 6 and 8 of the Succession Act, what portion would a Hindu widow receive?

judgement:

The honourable judge, YV Chandrachud, adopted the wider approach and observed that s. 6 contains a formula for determining the share of the deceased, creating a fiction of a notional partition.He said that one must therefore imagine a state of affairs in which a little prior to the (father’s) death, a partition of the coparcenary property was effected between him and the other members of the family, and the wife, though not entitled to demand a partition, was nevertheless entitled to get a share if the partition took place between her husband and her sons.So in the first partition, she will get one-fourth of the property in her own right and out of the one-fourth share of the husband, she will get a one-twenty fourth share by inheritance, a total of a seven-twenty fourth share.In relation to the interpretation of s. 6, the court said that what is required to be assumed is that a partition had in fact taken place between the deceased and the coparceners immediately before his death.Thus, the heir will get her share at the time of the notional partition and will also take a share at the time of inheritance, if entitled.The court noted that all the reforms that had taken place earlier were with a view to improving the property rights of women and a narrow approach would mean taking a retrograde step. It would put back the clock of social reform that enabled Hindu women to acquire an equal status with men.

This Court held that the deemed partition could not be limited to the periodimmediately preceding the death of the deceased coparcenary, but that“all the consequences that flow from a real partition must be logically worked out,” so the heirs’ share must be determined because they hadseparated from one another and received a share in the partition thatoccurred during the deceased’s lifetime.● The court said that the divide had to be recognized and acknowledged asa solid fact that could not be reversed afterward.

Uttam vs Saubhag Singh

facts:

Jagannath Singh, grandpa, died in 1973, leaving behind his widow and four sons.A grandson filed a suit for partition against his father and uncles, the father and uncles initially claiming that the father of the plaintiff had separated himself upon a prior partition, but on a later admission by the father that the property was indeed ancestral property.In this case, Grandson is plaintiff, where father is defendant no 1 and siblings of father are also defendant no 2, 3, 4.

Plaintiff’s contention

It was argued that because the deceased’s widow was alive at the time of his death, the case would fall within the proviso to Section 6’s jurisdiction. As a result, the deceased’s stake in the coparcenary property would pass through intestate succession rather than survivorship under Section 8 of the Act.

Defendant’s contention

The main argument was that if Section 8 is implemented, the joint family property ceases to be joint family property because of the application of the proviso to Section 6. Only Section 30 or Section 8 can be used to inherit such property if a will has been written or if a member of the joint family has died intestate.

issue:

Whether the joint family property kept its joint family character following Jagannath Singh’s death?Whether the appellant has a claim to the contested property by birth as a coparcener?Whether the appellant had the authority to file a partition action while his father (the Class 1 heir) was still alive?

judgement:

In order to determine the share of the Hindu male coparcener who is governed by section 6 proviso, a partition is effected by operation of law immediately before his death. In this partition, all the coparceners and the male Hindu’s widow get a share in the joint family property.On the application of section 8 of the Act, either by reason of the death of a male Hindu leaving self-acquired property or by the application of section 6 proviso, such property would devolve only by intestacy and not survivorship.Applying the law to the facts of this case, it is clear that on the death of Jagannath Singh in 1973, the joint family property which was ancestral property in the hands of Jagannath Singh and the other coparceners, devolved by succession under section 8 of the Act.This being the case, the ancestral property ceased to be joint family property on the date of death of Jagannath Singh, and the other coparceners and his widow held the property as tenants in common and not as joint tenants.This being the case, on the date of the birth of the appellant in 1977 the said ancestral property, not being joint family property, the suit for partition of such property would not be maintainable. The appeal is consequently dismissed.

As a coparcenary to the ancestral property, Uttam would have the right to his grandfather’s property. Unless it invoked the proviso, every coparcenary has a title on the ancestral property under Section 6.

Present Problem:

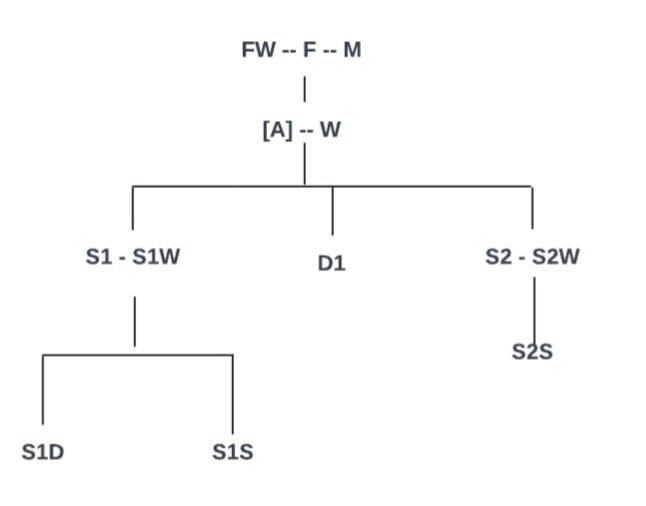

X, a Mitakshara Hindu died in 2001 and is survived by his widow W (whom he had deserted two years ago); S1 a son (converted to another religion during the life time of X); D1 a daughter (married in 1990) and D2 an unmarried daughter. He left behind both ancestral and separate properties. Ascertain the shares of his heirs in the aforesaid properties if t is governed by Mitakshara law as applicable in (a) Delhi;(b) Kerala. What would be your answer if X dies in 2016?

Answer:

[X] — W

——————————————–

| | |

S1 D1 D2–H

2001: Delhi + Kerala

Ancestral Property: notional partition– X=1/3; S1= 1/3; W=1/3; X’s share will be distributed among class1 heir, class 1 heir — W=1/4 + 1/12; S1=1/4 + 1/12; D1=1/4 + 1/12; D2=1/4 + 1/12; Separate property: W=1/4 ; D1=1/4 ; D2=1/4; S1=1/4

Sections 2 and 26 of the Succession Act, the two provisions have to be read together and not in isolation. On a reading of the two provisions, the convert himself or herself is not excluded from the application of the Succession Act. Only the descendants of converts are disqualified and not the convert.

2016: Delhi + Kerala

Ancestral Property: notional partition– X=1/5; S1= 1/5; W=1/5 D1=1/5; D2=1/5 class 1 heir — W=1/4 + 1/20; S1=1/4 + 1/20; D1=1/4 + 1/20; D2=1/4 + 1/20 ; X’s share will be distributed among class1 heir , Separate property: W=1/4 ; D1=1/4 ; D2=1/4; S1=1/4

A Mitakshara joint family consists of father F, mother M, son S, son’s wife W and unmarried daughter D. S dies in 1980 and the mother M dies in 1982. After the death of the mother; D wants to claim her share in the ancestral properties. Ascertain her share.Will it make any difference in your answer if S and M die in 2001 and 2012 respectively? Give reasons.

Answers: In 2001, D cannot claim share in property as she was not coparcenar. In 2012, D can claim share as she is a coparcenar after 2005 amendment, she will 1/2 share.

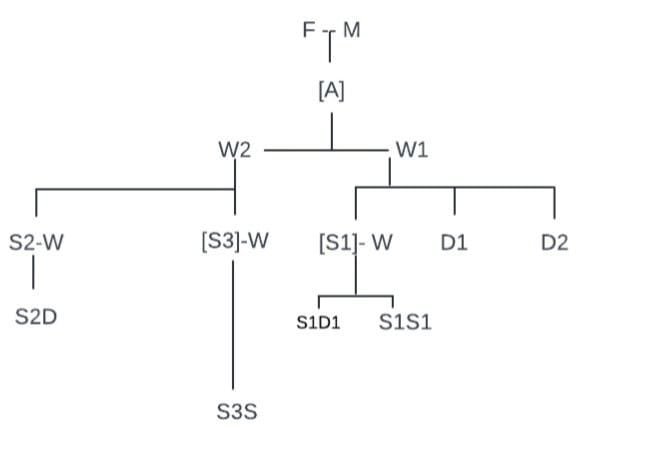

A Hindu male dies in 2010 as an individual member of Mitakshara Coparcenary and is survived by his parents F and M, a stepmother FW,a widow W, two sons S1, S2, and a daughter D1. F had married FW and M in 1950 and 1954 respectively. S1 had married W1 in 2000 and was blessed with one son and one daughter S15 and S1D. S2 had married a Christian woman under the Special Marriage Act, 1954 had a son S2S. The property consists of Rs. 20 crores.

Answer:

Class 1 heir:

M=1/5; W=1/5; S1=1/5; S2=1/5; D1=1/5

property is 20 Cr. Rs. which is divided among heirs 1/5 of 20 cr.= 4 cr. each

A, a Hindu male owned his separate property of 50 cr. Rs. He lived with his father F, mother M, his wife W1 and two daughters D1 and D2 and widow S1W and daughters S1D1 and S1D2 of his predeceased son S1. Without divorcing W1, A married W2 in 1970 and had two sons S2 and S3 from W2 and S2 married S2W and had S2D. S3 converted to become a muslim, married a girl Naureen and had a son Tousif. S1W remarried her college friend. S3 died in 1997. How would you separate property of A devolve if A died in (i) 2000, (ii) 2015

Answer:

Class 1 heir;

W=1/6; M=1/6; D1=1/6; D2=1/6; [S1] branch=1/6; S2=1/6

[S1] branch= 1/6 is divided among S1W, S1D1, S1S1; 1/3 of 1/6==

S1W=1/18; S1D1=1/18; S1S1=1/18

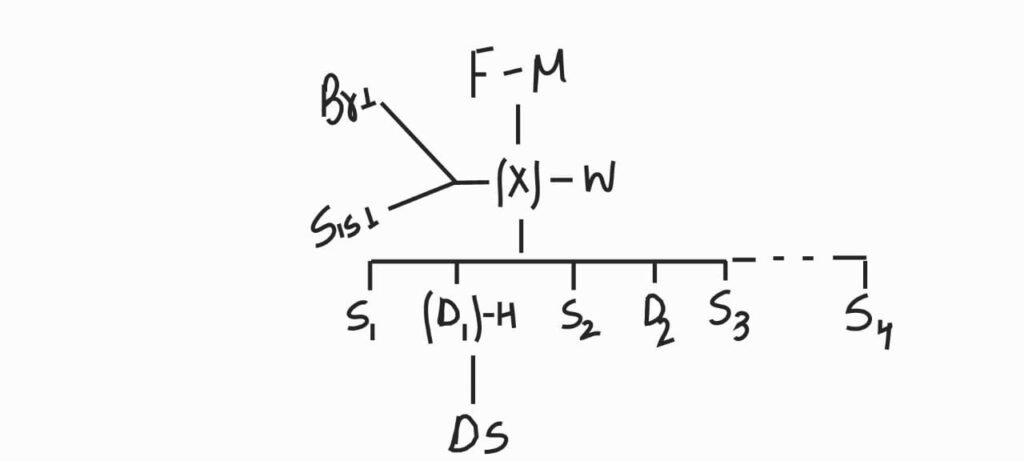

A dies in 2020 as an undivided member of Mitakshara coparcenary belonging to Delhi and is survived by his father, F, a step mother FW, a widow W three brothers Br1 Br2 and Br3 a sister S1S, three sons S1 S2 and S3 and two daughters D1 D2. S1was married to W1, and has a son SS, and a daughter SD,: S2 married a Christian woman under Special Marriage Act, 1954 and has one son SS1 from her. D1 is married to H and has two daughters D1D1and D1D2: The property consists of Rs. 4 Crores in cash and immovable property worth 20 Crores. Discuss who will get the property and what would be their shares? Would your answer be different if the family was domiciled in Tamil Nadu?

Answer:

Undivided Property:

We have to do 2 notional partitions

first, A, F, FW, Sis, Br1, Br2, Br3 = 1/7 each

second, in A ‘s family who are coparceners, i.e., A, W, S1, D1, S2, D2, S3 = 1/49 each as the share of A was 1/7 * 1/7 = 1/49

then, A ‘s share will go by succession into class 1 heir, i.e., S1, S2, S3, D1, D2, W = 1/49 * 1/6 = 1/294

so, S1 = 1/49 + 1/294; S2 = 1/49 + 1/294; S3 = 1/49 + 1/294; D1 = 1/49 + 1/294; D2 = 1/49 + 1/294; W = 1/49 + 1/294; F= 1/7; FW= 1/7; Sis= 1/7; Br1= 1/7; Br2= 1/7; Br3= 1/7;

‘X’, a Hindu male died intestate in 2020 and leaves behind property worth Rs. 80 Crores. He is survived by his parents F, M, a brother Br1,a sister S1S, widow W, three sons S1 S2 S3, and two daughters D1 and D2. ‘X also has an illegitimate son S4: His daughter D1 eloped with H,a married man with whom she has an affair and gave birth to a son DS from him. S1 during a fight killed D1 in 2015 and took defence that her conduct had bought shame on family and by killing her he has restored the honour of the family. Discuss who would get X’s property, specify the quantum, stating the reason for the same. Also, ascertain the shares of aforesaid relatives in X’s property if X was a female.

Answer:

Class 1 heir:

W=1/7; M=1/7; S1=1/7; S2=1/7; S3=1/7; [D1]=1/7; D2=1/7;

[D1]= DS=1/7

S4 being an illegitimate don’t have any right in property, but he can claim maintenance.

If the property belong to female, then,

property will go to her children and husband; S1, [D1], S2, S3, D2, X

S1= 1/6; S2=1/6; S3=1/6; [D1]= DS=1/6; D2=1/6; X=1/6

S4 will not get any share as he is illegitimate.