| Introduction | jurisprudence |

| sections | No sections |

| Relevant Case laws | Gulam Abbas vs Haji Kayyum Ali and others |

| Present problems | Questions related |

| conclusion | Decisions as per our reasoning |

Muslims are those who are governed by their personal law, i.e., Mohammedan Law. So the question is, Who are Muslims? A person can become a muslim by Birth, Conversion. A person can’t be a muslim by Marriage or by adoption unless he is a muslim by birth or converted into muslim.

Muslim can be seen in two sects: (i) Sunni, (ìì) Shia. 85% of Muslim population is Sunni and the rest is Shia. In these two sects laws, customs, traditions, theology, etc. are different from each other. So, likewise, law of inheritance is also different from each other.

Laws of inheritance under Muslim law are derived from the customs and usages prevalent among the tribes of Arabia before the revelations of the Quran, as supplemented and modified by the Quranic principles and the Hadis of the Prophet.The Sunnis kept the old framework intact, such as preference to agnates over cognates, and superimposed the Quranic principles on this old set-up. The Shias on the other hand, blended the old rules and the newly laid down rules. They revised the law prevalent under the Arabian customs and usages, in the light of the newly laid down principles and came out with a scheme widely different from the one propounded by the Sunnis.

Inheritance under Muslim law took place after the death of Propositus(whose property have to divide), and a child does not have any right in the property by birth. There are some steps to divide the property of propositus among heirs, i.e., first identify the heritable property, it means that the entire property of propositus will not go by succession but some deductions have to be made, like Secured or Unsecured debts, Bequeathable property(will), funeral expenses, servant expenses from total property, then we get heritable property which is going to divide among heirs of propositus. The whole property cannot be given under will, only 1/3 of entire property can be given as will and the remaining portion will succeed to the heirs.

General Principles of Inheritance:

- Nature of Heritable Property: It means that Property which is available to the legal heirs for Inheritance. Heritable property is the left portion of total property after deduction of funeral expenses, or servant expenses, or bequeath(will), or secured or unsecured debts.

- No birth right: inheritance under Muslim law is open after the death of propositus, no person have right by birth. Unless a person dies, his legal heirs are merely spes successionis.

- No concept of Joint Family Property: joint property concept is recognized in Hindu not in Muslims. There is no distinction of separate and ancestral property in Muslims.

- Doctrine of Representation: muslim law does not recognise doctrine of representation, it means that son of pre deceased son represents his father for the purpose of inheritance.

- Per capita and Per stripes: in sunni law, distribution is according to per capita means succession according to number of heirs(heads). But in Shia, distribution is per stripes, means several heirs who belong to different branches get their share only from the property available to which they belong.

- Female right of inheritance: both male and female have equal rights of inheritance. Male have no preferential right over female but generally male gets double share than female.

- Primogeniture: it is a rule in which property will go to the eldest son, it only applies to the son. If there is a eldest female and a young male then, preference will given to younger male. Sunni didn’t recognize it, but Shia do. Ring, Quran, Horse, Sword, Clothes will be provided to the son.

Heirs under Muslim law:

Sunni:

- Sharer

- Residuals

- Distant Kindered

Shia:

- Sharer

- Residuary

Sharer are the one who got first preference in inheritance. If there is no sharer, then residuary will get share, if it is not, then distant kindred. They are just like class 1 heir, then class 2 , then agnates, then cognates.

Sharers (Quranic Heirs) are those heirs who are entitled to get a prescribed share from the heritable property. Their shares are described in Quran itself and thus, it cannot be altered by human efforts. They get preference over other classes of heirs and first of all respective shares is allotted to each of the sharers.

Residuary are those who inherit property only residue property after allotment to sharer. There is no specific share given to them, they only get residue portion. But if there is no sharer, then entire property will go to residuary. Residuary are all male agnates and there are only four female who become residuary in some cases(daughter, son’s daughter, consaguine and full sister).

Distant kindred are those who are connected through bloods to the propositus, neither sharer nor residuary. They are also called Uterine heirs.

Sharer in Sunni:

- Wife (Widow) – takes 1/8 (one-eighth) part of share if she has children and ¼ in case of her being childless. She can never be excluded.

- Husband (widower) – gets 1/4 (one-eighth) shares, but in case he is childless, the share portion increases to 1/2 (one-half). He can never be excluded.

- Daughter – a single daughter gets 1/2 (one-half) shares. If there are two or more then they take 2/3 (two-thirds) of shares together. In the presence of a son, she becomes a residuary. She can never be excluded.

- Son’s daughter – gets 1/2 (one-half) shares and if two or more then, 2/3 (two-thirds) shares, only in absence of 2 or more daughters/ son/ higher son’s son/ 2 or more higher son’s son. If son’s daughter is together with one daughter, then share of son’s daughter(whether 1 or more)=1/6.In the equal presence of a son’s son, she becomes a residuary. Can be excluded under certain conditions.

- Full sister – a full sister gets 1/2 (one-half) shares and in case there are two or more in number they together take 2/3 (two-thirds) shares divided equally. In the presence of a full brother, she becomes a residuary. Can be excluded under certain conditions.

- Consanguine sister – gets 1/2 (one-half) shares and 2/3 (two-thirds) together if there are two or more. In presence of a full brother, share gets reduced to 1/6 (one-sixth) and in presence of a consanguine brother, she becomes a residuary. Can be excluded under certain conditions.

- Uterine sister – gets 1/6 (one-sixth) shares if single and 1/3 (one-third) together if two are more in number. Can be excluded under certain conditions.

- Uterine brother – gets 1/6 (one-sixth) shares if single and 1/3 (one-third) together if two are more in number. Can be excluded under certain conditions.

- Mother – gets 1/6 (one-sixth) shares and never excluded. Share increases to 1/3 (one-third) if there is no child or no son’s child or if she has a sibling. If the husband or wife of the deceased exists, then she gets 1/3 (one-third) of shares after deducting the shares of the husband or wife.

- Father – gets 1/6 (one-sixth) shares and is never excluded. When there is no child or son’s child then he becomes a residuary.

- True grandmother – gets 1/6 (one-sixth) shares. Under Certain exceptions she can be excluded.

- True grandfather – gets 1/6 (one-sixth) shares. Under certain exceptions he is excluded. If there is no child or son’s child, he becomes a residuary.

In Shia, Sharers are:

- Husband

- Wife (widow)

- Father

- Mother

- Daughter

- Full sister

- Consaguine sister

- uterine brother

- uterine sister

Shares of sharer in Shia is same as Sunni.

Doctrine of Radd

In accordance with the rules of inheritance the eligible sharers are given their fixed shares first and the residue left

passes to the residuaries. If there is no residuary, the residue in presence of the sharers does not pass to the

distant kindred but comes back or returns to the sharers and they are entitled to take it in proportion to their shares.

This coming back of the property to the sharers is called doctrine of ‘return’ or ‘radd’. The rule is subject to one

exception, viz. , the surviving spouse whether the husband or the wife is not entitled to take a share from the ‘return’

or ‘radd’, so long as any other sharer or even a distant kindred is present.

For example, a mother and a daughter, both being sharers, get 1/6 (one-sixth) and 1/2 (one-half) property respectively. Adding these shares together, we end with 2/3 (two-thirds) fraction which is less than unity (1). Thus, the remaining 1/3 (one-third) share is the residue. If there are no residuary heirs, this share, by the application of the doctrine of Radd, will be distributed among the shares again.

Doctrine of Aul

If the total of the shares allotted to the sharers is more than unity (1), then the excess amount is deducted from the daughter or from the consanguineous or full sister.

For example, if a Muslim woman dies, leaving her husband, father and 2 daughters, then each will get a share of 1/4 (one-fourth), 1/6 (one-sixth) and 2/3 (two-thirds) respectively and this adds up to 13/12 (thirteen-by-twelve) which is more than unity. By the application of the Doctrine of Aul, firstly the denominators are made common and are increased to the total sum of sharers. Hence 12/13 (twelve-by-thirteen) becomes 13/13. Then, new fractions of shares are allotted to the sharers, whereby the husband, father, and the two daughters get 3/13 (three-by-thirteen), 2/13 (two-by-thirteen) and 8/13 (eight-by-thirteen) respectively.

Disqualification:

Conversion: In muslim law, if anybody converts himself to another religion the he is disqualified from inheriting property whether sunni or shia.

Murderers: In sunni law, Murderer is disqualified from inheriting the property whether intentional or unintentional. But in shia law, Murderer is disqualified if it is done with the intention , if there is no intention, then he/she is not disqualified.

Illegitimate child: Under Sunni law an illegitimate child is deemed to be related to its mother, and inherits from her and her relations but does not inherit from the father or any of his relations. Under Shia law, an illegitimate child does not inherit from any of the parents nor from any of their relatives

Step- relations:

step relations are of two types, consaguine and affinity. Affinity means relation by marriage and consaguine means relation by blood and it is bifurcated into two, (i) Uterine Blood (ii) Half Blood. Step- children are not entitled to inherit property of their step- parents and vice versa. However, step- brothers can inherit each other’s property.

Relevant Case laws:

Gulam Abbas vs Haji Kayyum Ali and others

facts:

Kadir Ali Bohra died on April 5, 1952 leaving behind five sons, a daughter and his widow as his heirs. Thefirst appellate court, the final court on questions of fact, recorded the following findings, after examiningthe whole set of facts before it, to conclude that the plaintiff and Defendant 4 were estopped from claim-ing their shares in the inheritance. The High Court applied the principle that the estoppel can arise againststatute to what it considered to be an estoppel put forward against a rule of Mohammedan Law.

issue:

Whether a renunciation of an expectancy, as a purported but legally ineffective transfer, is struck bySection 23 of the Indian Contract Act.

judgement:

A bare renunciation of expectation to inherit cannot bind the expectant heir’s conduct in future. While theMadras view is based upon the erroneous assumption that a renunciation of a claim to inherit in future isin itself illegal or prohibited by Muslim Law, the view of the Allahabad High Court correctly lays downthat such an abandonment may be part of a course of conduct which may create an estoppel againstclaiming the right at a time when the right of inheritance has accrued. An arrangement which may avoidfuture disputes in the family, even though it may not technically be a settlement or definition of actuallydisputed claim, was referred to broadly as a “”family arrangement”. As the law relating to family arrangements is based on English Law, a family arrangement is defined as an agreement between members of thesame family intended to be generally and reasonably for the benefit of the family either by compromisingdoubtful or disputed rights or by preserving the family property or the peace and security of the family byavoiding litigation or by saving its honour.

The plaintiff and Defendant 4 were estopped by their conduct, on an application of Section 115, EvidenceAct, for claiming any right to inheritance which accrued to them, on their father’s death, covered by thedeeds of relinquishment for consideration, irrespective of the question whether the deeds could operate aslegally valid and effective surrenders of their spes successionis. Upon the facts and circumstances in thecase found by the courts below, the plaintiff and Defendant 4 could not, when rights of inheritance vestedin them at the time of their father’s death, claim these as such a claim would be barred by estoppel. The re-sult is that the appeal is allowed, the judgment and the decree of the High Court are set aside, and that ofthe first appellate court is restored. In the circumstances of this case, the parties will bear their own costs.

Present problem:

X, a Sunni Muslim, dies intestate in 2010 leaving behind two widows W, and W2 a son S, two married daughters D1 and D2 son of a predeceased son SS as his heirs. Ascertain the shares of the aforesaid heirs in the property of X.

Answer:

Sharer:

W1 and W2 will get 1/8 divided equally, W1=1/16; W2=1/16; as there is no other sharer here because daughter becomes residuary along with son. We are left with 7/8 share, then doctrine of Radd will apply here. Widow or widower are out in this doctrine when share have to redistribute. As there is residuary here (daughters, son and son’s son).

So, 1/3 of 7/8 = 7/24 to be distributed among S1, SS and D1 & D2. Son will get double share than daughters.

S1 + D1 + D2 =7/8

2x + x+ x = 7/8

5x = 7/8

x= 7/40

so, share of S1= 7/40 × 2 = 7/20; D1= 7/40; D2= 7/40;

S1= 7/20; D1= 7/40; D2= 7/40;

So, 1/16 + 1/16 + 7/20 + 7/40 + 7/40 == 1.

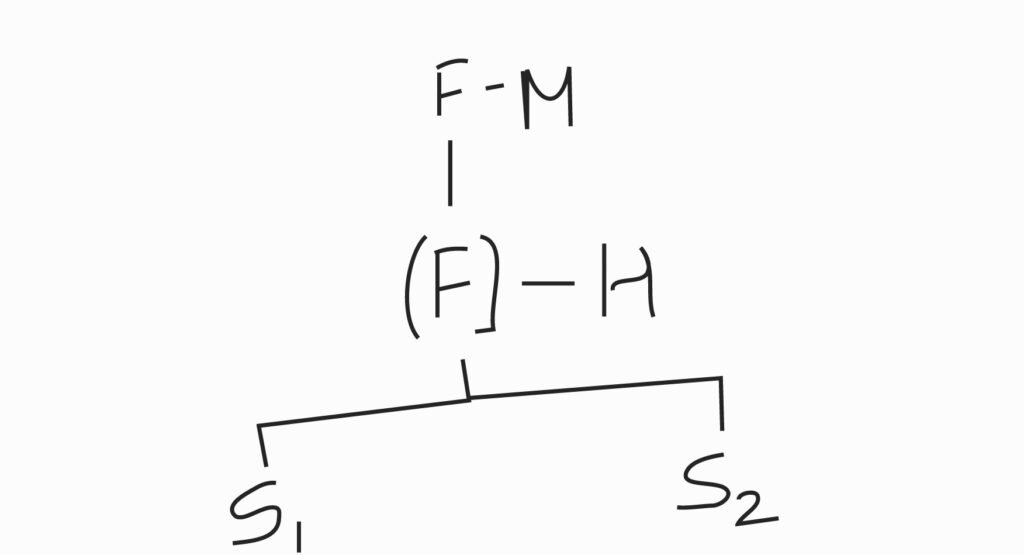

Ascertain the shares of the following heirs under Sunni law:(i) X, a male dies leaving behind widow W, a daughter D1 and daughter of a predeceased son D1S.(ii) F, a female dies leaving behind widower H, mother M, father F and two son S1 and S2″.

Answer: (i)

Sharer : W=1/8; D1 = 1/2 ; so 1/8 + 1/2 = 5/8;

left portion = 3/8

so, as per doctrine of radd widow will not get any share and there is also no residuary here

so the whole portion 3/8 will be provided to D.

sunni didn’t recognize doctrine of representation.

(ii)

Sharer: F=1/6; M=1/6; H=1/4; so, 1/6 + 1/6 + 1/4 == 7/12 , we are left with 5/12 , doctrine of Radd applies here. It will distribute among residuary as they are resided here( S1 and S2).

1/2 of 5/12 = 5/24 , S1= 5/24; S2=5/24; now, 1/6 + 1/6 + 1/4 + 5/24 + 5/24 == 1.

“X’, a Muslim dies intestate and is survived by his Parents M and F,a brother Br, a sister SIS, a widow W, two sons S1 and S2 a daughter D1 and a widow, a son and daughter of a predeceased Son S3W, S3D1,S3S1 of son S3. ‘X’ left behind the property worth Rs. 50 Crore. Discuss who will get the property and what will be their shares? What would be your answer, if ‘X’ was a female and ‘W’ was the widower?

Answer:

Sharer:

W=1/8; M=1/6; F=1/6; so, 1/6 + 1/6 + 1/8 = 11/24; we are left with 13/24 which will distribute among residuary, i.e. Son and Daughters.

The share is divided in the way that daughter will get half of son’s share.

S1 S2 D1 = 13/24

2x + 2x + x = 13/24

5x = 13/24

x = 13/24 * 1/5

x = 13/120

so, son will get double than daughter, 13/120 * 2 = 13/60

S1= 13/60; S2=13/60; D1=13/120;

S3’s share will not get.

50 cr. property, W= 50 *1/8 = 6.25 cr.

F= 50* 1/6 = 8.33 cr.

M= 50* 1/6 = 8.33 cr.

S1= 50*13/60 = 10.83cr.

S2= 50* 13/60 = 10.83 cr.

D1 = 50* 13/120= 5.42 cr.

If X is female, then

W = 1/4; F = 1/6; M = 1/6; =1/4 + 1/6 + 1/6 == 7/12, we are left with 5/12

residuary —- S1, D1, S2

S1 S2 D1 = 5/12

2x + 2x + x = 5/12

5x = 5/12

x = 5/12 * 1/5

x = 5/60

so, S1, S2, S3 will get = 5/60 * 2 = 5/30; D1 = 5/60;

50 cr. property,

W = 50 * 1/4 = 12.5 cr.

F = 50 * 1/6 = 8.33 cr.

M = 50 * 1/6 = 8.33 cr.

S1 = 50 * 5/30 = 8.33cr.

S2 = 50 * 5/30 = 8.33cr.

D1 = 50 * 5/60 = 4.17 cr.

A Muslim male Rehan was survived by his wife – Uffak, his daughter Sara, sons Aadil and Aquil, son of his predeceased son Khurram, his father Kamaal, his father’s father Beg his full brother Rafiq. Aquil baptized himself to become Christian. On altercation between Rehan and Adil, Rehan slapped Adil and Adil in fit of rage pushed Rehan out from his room but Rehan fell from second floor on the ground floor and died immediately. Discuss the shares of the heirs of Rehan, if Rehan was: (i) Sunni (ìì)Shia

Answer:

Sharer: Sunni

Kamaal(father) = 1/6; Uffak(widow) = 1/8; Sara = 1/2

Adil is disqualified as he is a murderer and aquil also disqualified as he converts himself.

1/6 + 1/8+ 1/2 = 19/24

left portion = 5/24

Doctrine of Radd will apply here,

Kamaal and Sara will get share

kamaal : Sara

3 : 1

5/24 * 3/4 : 5/24 * 1/4

5/28 : 5/96

so, Sara = 1/2 + 5/96; Kamaal= 1/6 + 5/28; widow= 1/8

Shia:

Father = 1/6; widow = 1/8; so, 1/6 + 1/8 = 7/24

left portion = 17/24

Residuary,

Sara, S3; Adil

Adil will get share as his intention was not to murder his father and aquil will also not get anything as he had convert himself.

Adil + Sara = 17/24

2x + x = 17/24

3x = 17/24

x = 17/24 * 1/3

x = 17/72

[S3]= Khurram will get double share than Sara. so, 17/72 * 2 = 17/36

Sara = 17/72

Adil = 17/36